Comprising Sweden, Denmark and Norway, the Scandinavian coffee shop market has a strong focus on specialty and premium coffee, popularised by well-known brands including Swedish chains Espresso House and Johan & Nyström, as well as pioneering Copenhagen-based roastery, The Coffee Collective

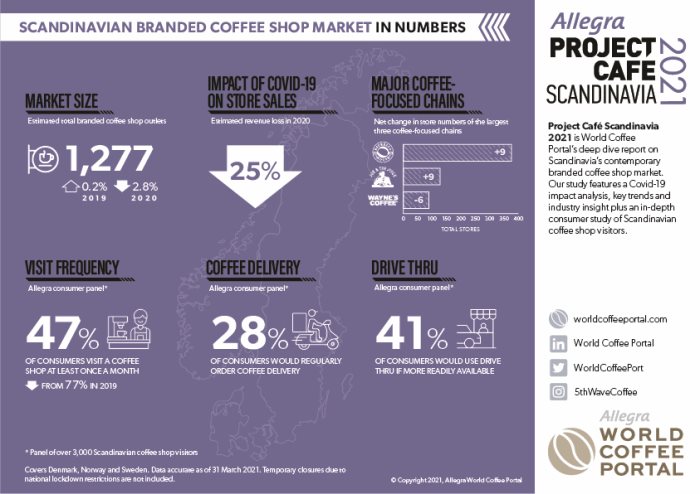

Sales revenue fell by an estimated 25% across Scandinavia in 2020 largely down to national lockdowns in Denmark and Norway and decreased consumer confidence felt in Sweden | Source: Project Café Scandinavia 2021

In 2020, Covid-19 disruption across the total Scandinavian coffee shop market saw revenues fall by around one quarter, with the market contracting 2.8% to 1,277 outlets. The Danish market decreased 1% to 388 stores, Norway shrank 3.1% to 375 outlets, with Sweden experiencing the largest contraction of 3.9% to 516 stores.

Denmark and Norway took broadly similar responses to the pandemic in 2020, opting, like most European countries, to impose national lockdowns and shutter non-essential businesses, including coffee shops. By contrast, Swedish hospitality businesses stayed open until December 2020 with the government aiming to soften the pandemic’s economic impact.

However, the Swedish market suffered a greater contraction than its neighbours, suggesting consumer confidence weakened in spite of cafés remaining open in the context of the government’s more relaxed approach to Covid-19.

While 94% of Scandinavian consumers surveyed indicate they typically consume coffee at least once a week, the proportion visiting coffee shops at least once a month has fallen from 77% to 47% year-on-year due to the Covid-19 pandemic. Starbucks is the preferred coffee chain among consumers in Denmark and Norway, while Swedish consumers favour domestic brand Espresso House.

.jpg.aspx?width=700&height=466)

A distinct focus on higher quality handmade food and beverages across Scandinavia's three largest chains highlights the region's strong domestic premium coffee offering

However, Scandanavia’s three largest coffee chains, Espresso House, Joe & The Juice and

Wayne’s Coffee, all have a distinctly premium focus, highlighting the regional preference for higher quality, hand-made food and beverages. Serving 100% Arabica coffee, organic products and ethical credentials were cited as the top three factors defining a high-quality coffee shop by Scandinavian consumers surveyed.

Scandinavian consumers surveyed appear less willing to try coffee delivery than their European counterparts, with just 28% indicating they would regularly use such a service if it were more readily available. This indicates that Scandinavian operators must double down on providing inviting and Covid-19 secure store spaces for customers to enjoy. Sixty-two percent of industry leaders surveyed believe that consumers should feel safe when visiting Scandinavian coffee shops now, while 15% disagree.

World Coffee Portal forecasts the total Scandinavian branded coffee shop market will return to pre-pandemic levels by 2024, growing at 1.4% CAGR over the next five years to reach 1,369 outlets. Demark is expected to lead the region’s growth with a projected 3.2% CAGR over the next five years, followed by Norway at 1.5% CAGR. The recovery will be slowest in Sweden, which experienced the largest contraction in outlets, and is projected to grow at 0.9% CAGR.

Project Café Scandinavia 2021 is World Coffee Portal’s first-ever deep-dive study into Denmark, Norway and Sweden’s contemporary branded coffee shop markets.

The report features market sizing and growth forecast, Covid-19 impact analysis, industry insight, and a consumer study featuring over 3,000 Scandinavian coffee shop visitors.