Covid-19 has caused extraordinary upheaval for Europe’s branded coffee chains over the last 12 months, with nearly half of the continent’s coffee shop markets experiencing net stores declines. Driven by a strong domestic food-focused segment, France’s branded café market grew 2.5% over the period, with French consumers coveting coffee quality and healthy options and key purchase drivers

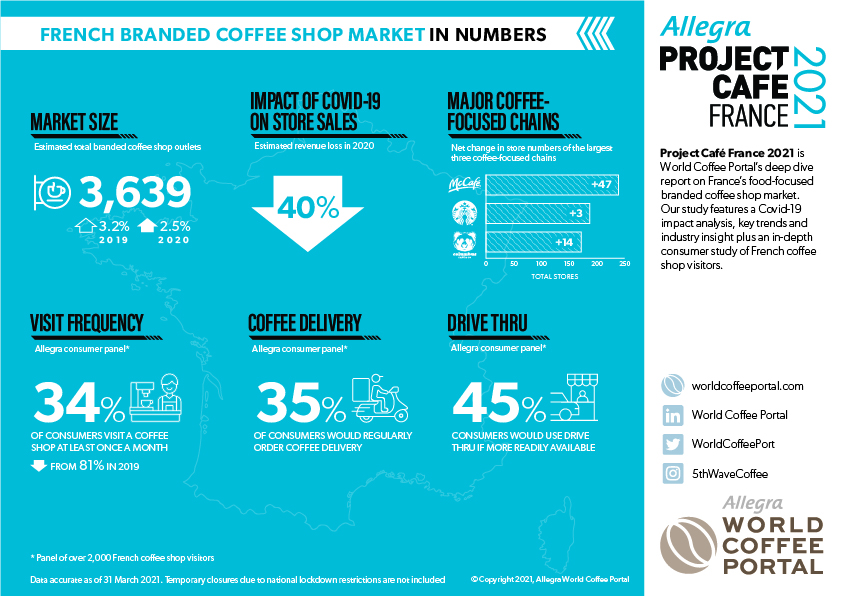

Lockdown restrictions across France led to an estimated 40% revenue loss for coffee shops in 2020 - one of the highest rates in Europe | Source: Project Café France 2021

The French branded coffee shop market was severely impacted by the Covid-19 pandemic, with cafés and coffee shops forced to shutter repeatedly throughout the year and fresh lockdowns continuing into 2021. These restrictions led to an estimated 40% revenue loss for French coffee shops – one of the highest rates in Europe.

Further highlighting the impact of Covid-19 trading restrictions on French hospitality businesses, the proportion of consumers indicating they visit a coffee shop at least once a month fell to 34% compared with 81% the year previous. Reflecting tough market conditions, the proportion of industry leaders expressing positivity on current trading has fallen from 84% to 47% year-on-year.

Despite these challenges, the French branded coffee shop market grew 2.5% to reach 3,639 outlets in 2020. Underlining the healthy appetite for coffee culture 95% of consumers surveyed indicate they typically consume coffee, providing a robust consumer base for those operators able to adapt to new consumer routines.

As a result of temporary in-store trading restrictions, the proportion of consumers purchasing beverages to-go from coffee shops has increased from 22% to 34% over the last 12 months. Reinforcing the strong tradition of out-of-home food and beverage culture in France, 68% of consumers believe handmade barista beverages add value to their purchase. Offering 100% Arabica coffee is considered the most important marker of coffee shop quality among French consumers.

.jpg.aspx?width=700&height=466)

Healthy food and beverage options are key purchase drivers for French coffee shop visitors

Health is also an important consideration. Fifty-five percent of French consumers surveyed are more likely to purchase beverages with health claims, rising to 58% for under-35s. Forty-four percent say they would be more likely to purchase iced beverages if they were healthier. Indulgence, however, remains the primary impetus for purchasing iced beverages in coffee shops.

Indicating French coffee shops are hitting the mark with health-conscious consumers, 65% of those surveyed said they were satisfied with the range of healthy food choices in coffee shops, with just 11% dissatisfied.

World Coffee Portal observes the recovery of the French coffee shop market will be highly dependent on the country’s Covid-19 vaccination roll-out. Although the vaccine programme is already well underway, it has been hindered by supply issues, vaccine distrust, and a rise in cases in the second quarter of 2021.

Project Café France 2021 is World Coffee Portal’s annual deep-dive study into France's food-led branded coffee shop market.

The report features market sizing and growth forecast, Covid-19 impact analysis, industry insight, and a consumer study featuring over 2,000 French coffee shop visitors.