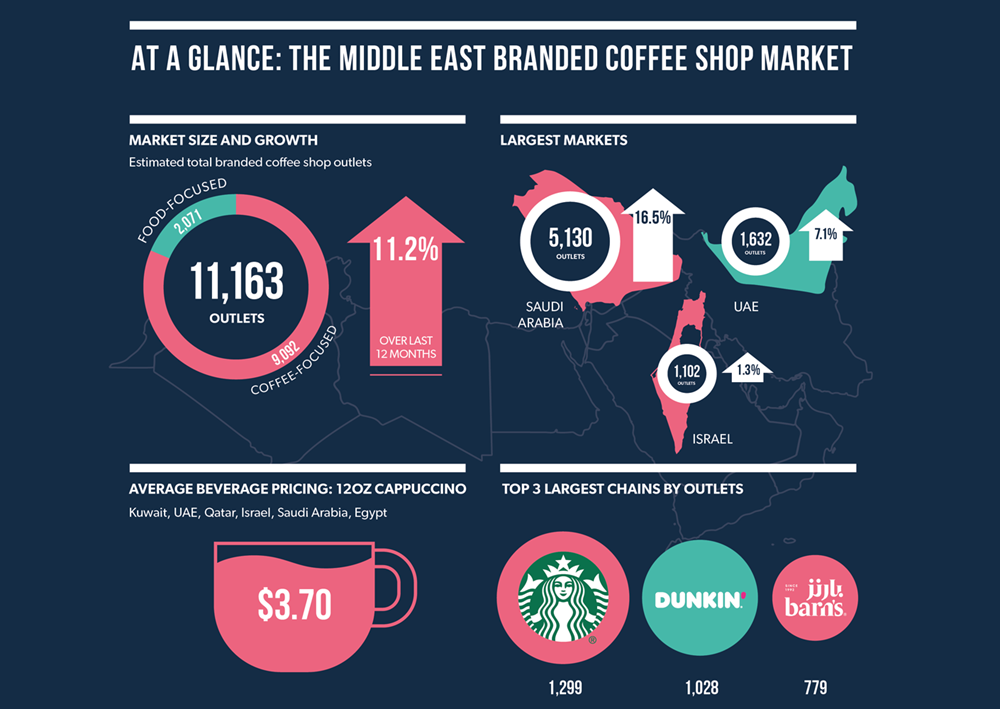

Project Café Middle East 2025, World Coffee Portal’s strategic analysis of 20 Middle East and North Africa (MENA) branded coffee shop markets, shows the total segment grew 11% over the last 12 months to reach 11,163 outlets. As Saudi Arabia and the UAE cement their status as key regional hubs for coffee commerce and innovation, emerging markets, such as Morocco and Jordan, are increasingly attracting investment from operators in the region and further afield

.png.aspx?lang=en-GB&width=700&height=496)

Download the Project Café Middle East 2025 infographic | Photo credit: © World Coffee Portal

World Coffee Portal data shows the MENA branded coffee shop market has achieved double-digit outlet growth for three consecutive years, led by expansion across Saudi Arabia, the UAE and Egypt. Despite growing geopolitical tensions in the region, 14 out of 20 MENA markets featured in the report achieved outlet growth over the last 12 months, as domestic operators gain significant ground in many markets traditionally dominated by international coffee chains.

Saudi Arabia remains epicentre of robust MENA branded coffee shop market

Saudi Arabia is the largest branded coffee shop market in the MENA region with 5,130 outlets and over 120 branded coffee chains currently operating. Led by US coffee chain Dunkin’, domestic operator Barn’s and Seattle-based Starbucks, the Saudi market accounts for 46% of all branded coffee shops across the Middle East.

Building on its strong coffee heritage, Saudi Arabia is investing heavily in coffee cultivation, roasting, trading and hospitality as key components of the Saudi 2030 Vision. The Saudi market is home to the highest number of unique branded coffee shop operators in the Middle East and has also produced six of the 20 largest chains in the region, including Barn’s, Kyan Cafe and Mezaj Magribi.

.jpg.aspx?lang=en-GB&width=700&height=467)

Saudi Arabia has produced six of the 20 largest chains in the MENA region, including Barn’s (pictured) | Photo credit: Barn’s

Trading largely positive in the shadow of regional conflict

Supply chain disruption, economic instability and security remain key concerns for MENA industry leaders amid heightened tensions in the region, particularly the Israel-Gaza war and ongoing crisis in Yemen. Political unrest in the Middle East has negatively impacted trade through the Red Sea – one of the most significant coffee shipping routes globally – causing significant delays and higher costs for coffee businesses.

These headwinds present potential barriers to growth, particularly for western chains facing sustained consumer boycotts over their perceived stance on the Israel-Gaza conflict. However, only two MENA markets – Lebanon and Tunisia – saw market contractions of 9.1% and 19.3% by outlets respectively.

Additionally, nearly three-quarters of industry leaders report current trading in their market is positive, with 76% achieving sales growth over the last 12 months.

Boutique operators catalyse growing regional demand for specialty coffee

Over 80% of Saudi Arabia and UAE industry leaders surveyed view specialty coffee as important for coffee shops in their market. This dynamic is reflected by nearly three quarters of consumers surveyed across both markets, who identified specialty coffee as a key feature for high-quality coffee shops.

Highlighting opportunities for specialty coffee operators in the region, Moroccan-inspired heritage brand Bacha Coffee and French-Japanese inspired café concept Café Kitsuné each entered three new MENA markets over the last 12 months. Additionally, Egypt’s Koffee Kulture, Kuwait’s Vol.1, Saudi Arabia’s Row and the UAE’s Roasters Specialty Coffee are now classified by World Coffee Portal as branded coffee chains after reaching five or more stores.

Bacha Coffee launched in the UAE with a Dubai Mall outlet (pictured) in January 2024 | Photo credit: Bacha Coffee

Branded coffee chains forecast to maintain strong outlet growth despite market headwinds

With deep-rooted coffee traditions fuelling demand for aspirational hospitality experiences, particularly among social media-savvy Gen Z consumers, World Coffee Portal forecasts most MENA markets will maintain healthy outlet growth over the next five years – only the Israeli and Lebanese markets are expected to contract.

Project Café Middle East 2025 forecasts the total MENA branded coffee shop market will exceed 12,160 outlets by November 2025 and 16,460 stores by November 2029, representing five-year growth of 8.1% CAGR. Saudi Arabia is expected to lead outlet growth, while Morocco is forecast to be the fastest-growing market at 19.2% CAGR.

Commenting on the report findings, Allegra Group Founder and CEO, Jeffrey Young said: “The MENA branded coffee shop market continues to remain robust despite difficult headwinds and a complex trading environment across many markets in the region. It’s great to see the emergence of a number of boutique operators gaining traction in the market, which all points towards a premiumisation of the coffee industry across the MENA region.”

*Project Café Middle East 2025 provides market sizing for Algeria, Bahrain, Djibouti, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine State, Qatar, Saudi Arabia, Syria, Tunisia, United Arab Emirates and Yemen.

Project Café Middle East 2025 is World Coffee Portal’s definitive annual study of the 20 strong branded Middle Eastern coffee shop sector. The research includes market sizing, sector-by-sector insight, beverage pricing, brand profiles and an in-depth survey of more than 2,000 UAE and Saudi coffee consumers.

To purchase the report or to make an enquiry, contact:

enquiries@worldcoffeeportal.com

+44 (0) 20 7691 8800