New York’s world-famous coffee shops were hit hard by the pandemic, but tenacity and innovation have enabled many operators to bounce back from two years of trading restrictions. With profound changes in consumer behaviour generating new trading realities and uncertainty, many question whether the market will ever be the same again. 5THWAVE magazine explores how New York's coffee shops are navigating a changed landscape and what the future holds in the city that never sleeps

Has the Big Apple bounced back from Covid?

New York has long captured imaginations around the world. A melting pot of cultures and cuisines, the five boroughs represent boundless opportunity tempered with fierce competition, fast-paced lifestyles and notoriously discerning consumers.

As famous Brooklynite Howard Schultz wrote in his book,

Pour Your Heart Into It: “New York held special symbolism for me, since it’s my home town as well as the nation’s biggest city. But with its high rents and tough labour market, it also concerned us. Specialty coffee was catching on all over the country, competition was heating up,” referring to Starbucks’ New York debut in 1993.

For New York’s revered coffee shop community, those dynamics still ring true nearly 30 years later as it grapples with deep change following Covid-19.

As the city has gradually recovered from the pandemic over the last 12 months, a changed coffee shop market has emerged, characterised by fewer in-store visits, more app-based transactions and increased footfall at neighbourhood stores. But how far will these changes become permanent and will the market spring back to its pre-pandemic shape?

“So much has changed – two-and-a-half years is a very long time for specialty coffee in New York City,” says Jonathan Rubinstein, CEO of Joe Coffee, a revered specialty coffee business with 25 stores in the city.

Although footfall, trade and the availability of skilled staff has improved, Rubinstein reflects that Covid restrictions have taken their toll on the ambience of many coffee shops.

“We’re getting closer to normalcy every month, but it’s different than it was. In some ways, we may have forgotten what ‘normal’ is, especially things like porcelain cups, indoor seating and seeing a smile,” he says.

"There is more real estate available right now than I have seen in 19 years"

– Jonathan Rubinstein, CEO, Joe Coffee

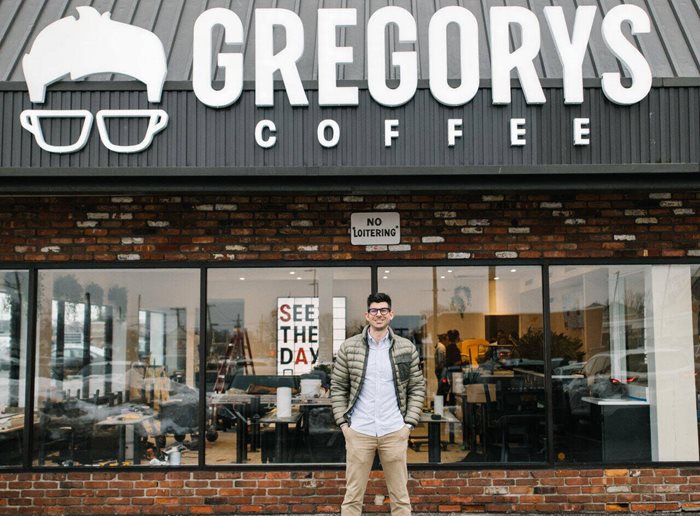

Gregorys Coffee is another celebrated member of New York’s coffee shop scene, operating 36 stores in the city, predominantly in the Manhattan area.

Founded in 2006, Gregorys navigated the unfolding 2007-8 financial crisis during its early years, but the business’ CEO Gregory Zamfotis says today’s challenges are unique.

“The financial crisis didn’t hit everybody at the same time so quickly. We weren’t facing the confluence of factors we have today,” he says.

Zamfotis says the fallout from the pandemic, including rising costs and supply chain disruption, has visibly impacted consumer confidence in New York.

“Groceries are meaningfully more expensive compared to nine months ago. The cost of housing is a continual issue. Of course, there are still health concerns around Covid,” he says.

“You start thinking in poker terms: What’s the next card going to be?”

Transaction data from the Bank of America Institute in July 2022 indicated New York coffee shop sales were around 70% of their pre-pandemic peak in January 2020, compared to around 140% in California and North Carolina and close to 200% in Texas.

Gregory Zamfotis, CEO and Founder, Gregorys Coffee | Photo credit: Gregorys Coffee

A report from the think tank on New York coffee shops indicates profound changes in consumer behaviour, notably remote working, are impeding a return to pre-pandemic footfall in the city.

But the data also tells another story – Midtown coffee shop sales are above the US average, at around 80% and 70% respectively.

Rubinstein is also optimistic about the current trading environment in New York. “We are hovering near 2019 numbers but not quite there yet,” he says.

Joe Coffee had two store casualties during the pandemic. However, the business has also been able to acquire three premises vacated by other coffee shops over the last year.

“It’s the fastest we’ve grown,” says Rubinstein. “There is more real estate available right now than I have seen in 19 years at Joe Coffee.”

Zamfotis also indicates a recovery in trading, with overall sales at the time of writing in late August 2022 at around 85% of pre-pandemic levels. Nevertheless, factors such as the return of mass-tourism in the summer and increased home working mean the trajectory of the recovery, particularly at store level, remains difficult to predict.

“We finally started to see momentum in the spring, but there just aren’t as many folks in the office anymore. Our stores that have exceeded pre-pandemic levels have been lifted by tourism,” he says.

As in markets the world over, the impact of Covid-19 has fundamentally changed coffee shop visitation patterns in New York. Remote working has profoundly impacted coffee shop trade, including a shift away from traditionally high footfall locations, such as office districts and travel hubs, towards neighbourhood locations.

Bank of America Institute data indicates US workers are now spending around one third of all paid working days at home. This, the research suggests, means that although coffee shop trade rebounded significantly following the lockdowns of 2020, the recovery has now slowed in New York.

“The pandemic has set off the structural changes in the economy in the way of work,” says David Tinsley, Senior Economist, Bank of America Institute.

“The hiring market has shifted so that people will be offered roles that don’t necessarily locate them close to an office. Retailers are built for a certain number of workers and they tend to be located around offices and high footfall hubs because people grab breakfast and a coffee on their commute or attend meetings in a coffee shop.

“There is now a displacement where some demand has shifted out of those areas. However, it’s likely that pandemic anxiety preventing some commuters from going into the office will abate over time,” Tinsley adds.

"The hiring market has shifted so that people will be offered roles that don't necessarily locate them close to an office"

– David Tinsley, Senior Economist, Bank of America Institute

This dynamic has compelled coffee shops large and small to consider outlet growth in residential areas, a greater focus on delivery and the introduction of smaller format stores in city centre locations.

Joe Coffee’s Rubinstein agrees neighbourhood stores have benefited from increased remote working, while those in commercial districts have yet to fully recover.

“Neighbourhood areas are nearly at 100% but those in commercial districts – Grand Central Terminal, the World Trade Centre, Midtown – are trailing significantly at 50-75%.”

Although remote working has caused a shift in trading patterns, Rubinstein says overall footfall is steadily recovering, albeit during unfamiliar dayparts.

“If customers are working from home, they might get coffee at 10:30- 11am instead of 7-9am, but they are definitely coming back.”

Henry Roberts is CEO and Founder of Two Hands Coffee, a celebrated Australian-inspired café business that opened its first store in New York in 2014. Roberts also points to an asymmetric recovery across his five cafés following the pandemic, with delivery trade skyrocketing in some locations and others struggling to regain ground lost during lockdowns.

While one store in Noho earns around $7,000-$10,000 per week on the DoorDash platform, the same menu five blocks away makes just $1,000.

“We used to do very little delivery pre-Covid. We didn’t really care for it because we preferred connecting with the community, but now it’s become huge in some stores. It’s also created a shift in labour, which is now lower in terms of overall costs, even though it has increased per employee,” says Roberts.

Joe Coffee also tapped into digital transactions during the pandemic, developing an order-ahead and payment app to cater to increased takeaway sales amid in-store dining restrictions.

Joe Coffee, Dumbo | Photo credit: Joe Coffee

“It's been pretty successful and accounts for around 12% of our orders, which doesn’t sound like much but is significant when you’re doing 15,000 sales a day.”

Meanwhile, Gregorys Coffee, which has long counted Manhattan as its heartland, is exploring growth outside of the city centre, and has opened its first drive-thru location in New Jersey.

“Historically, we were concentrated on daytime office population areas,” says Zamfotis. “But now more than ever we’re finding residential neighbourhoods make a lot of sense – there are so many great communities in New York that we have not yet been a part of.”

When it comes to pre-pandemic trading patterns returning to normal, Bank of America’s Tinsley says it’s difficult to predict how far the market will snap back to its previous shape. “Some city centres will bounce back straight away. I suspect those that are the most tourist-centric, like New York, will largely benefit from that. Some that don’t attract as many visitors may continue to see structural change in demand due to working from home,” he says.

Food for thought

From Italian to Greek and Vietnamese, New York is a melting pot of coffee cultures. More recently, the city has embraced a new wave of Australianinspired cafés. Combining speedy service with approachability and first-class food and beverages, a new crop of operators, including Bluestone Lane, Ruby’s Café and Saltwater Coffee have found favour across the city.

Two Hands is among them, and Roberts says serving food alongside coffee has proved popular with customers with the added benefit of generating higher average tickets.

"As a business owner, you're wondering how can you turn a $4 coffee into a $15 ticket"

– Henry Roberts, CEO & Founder, Two Hands Coffee

“High rents in New York mean it’s difficult for coffee shops to make a profit. Even if it’s just a hole in the wall, you need to have a line out the door for coffee all day. That doesn’t happen anymore because people aren’t going to wait an hour for latte – they can go elsewhere.

“As a business owner, you’re wondering how you can turn a $4 coffee into a $15 ticket. After you’ve added more seating and kitchen space to serve food, you’ve turned into a café rather than a coffee shop,” says Roberts.

Even with the benefits of higher average tickets, Roberts says trading in New York remains tough, with one of his stores yet to fully regain its prepandemic margins.

“We have pretty cheap rents, but we’re still struggling to crack 14% profit since Covid, and we usually aim for 20% at the store level.”

Gregorys Coffee has also grown its food offer to increase average tickets, which has enabled the business to avoid implementing price increases elsewhere. Stores are now equipped with kitchens to prepare food on-site to strengthen sales during the key morning and lunch dayparts.

“We’ve incorporated a hot breakfast and hot sandwich programme, which we didn’t have in a meaningful way before Covid. This helped us gain a wider audience and negate some of the traffic loss,” says Zamfotis.

"New York is a very special place that will always find a way to reinvent itself"

– Gregory Zamfotis, CEO and Founder, Gregorys Coffee

A labour of love

The US Bureau of Labor Statistics reports that six million restaurant and bar workers – nearly half the US hospitality workforce – lost their jobs during the first wave of the pandemic in 2020. According to the government organisation, a further 400,000 were laid off as the virus surged again in January 2021.

Joe Coffee’s Rubinstein says staff shortages have become one the most challenging aspects of doing business in New York following the pandemic. “We always prided ourselves on low staff turnover – then we had 95% turnover when Covid caused us to shut down for the first time.”

“When we needed to re-open, we couldn't find enough bodies and the calibre of talent wasn't what it was before. It takes a long time to train a real coffee professional.”

However, Rubinstein says the staffing situation has improved over the last few months. “There are certainly more people back in the city and looking for service jobs than there were six months ago,” he adds.

Two Hands’ Roberts agrees the market for hospitality workers has been challenging since the pandemic. A seasoned hospitality worker himself, Roberts recalls long queues for job interviews when he first arrived in New York during the 2010s.

“It blows my mind because the labour market is so hard now. “It’s almost like anyone who walks through the door gets the job,” he says.

Labour shortages have also increased wage expectations, with cook staff now typically seeking $21-$22 per hour as opposed to around $16 pre-pandemic. “I understand the argument behind it but adding $6 an hour on to every back-of-house person is really tough for a business,” Roberts says.

Photo credit: Two Hands Coffee

Is New York back in business?

It’s evident that New York’s coffee businesses have been grappling with profound changes following the pandemic, with longstanding trading patterns upended and footfall at typically busy locations becoming unreliable.

New York will always be a special place for Two Hands says Roberts; however the Australian entrepreneur is also looking further afield to grow his business as specialty coffee culture blooms across the US.

“I love New York, but it’s tremendously challenging. We’re going into Denver, Colorado, Dallas and Texas over the next couple of years. There’s a lot of demand for coffee and café culture and on top of that there are the benefits of lower rent and taxes,” he says.

Looking to the future, Zamfotis acknowledges New York trading conditions are tough but points to the resilience of the city’s coffee shops though other recent crises.

“Whether it’s 9/11, the financial crisis, or after Hurricane Sandy decimated Lower Manhattan, we always made a bet on recovery,” he says. “New York is a very special place that will always find a way to reinvent itself.”

At Joe Coffee, Rubinstein says growing appetite for specialty coffee continues to fuel opportunities for both new and existing coffee shops in the city.

“There is still a high density of people who are interested in coffee and café culture, with some top-notch brands and experiences emerging. The biggest reason for that is growing consumer awareness of specialty coffee. When Joe Coffee first opened, we were a niche offering that most people hadn’t experienced. Now, everybody is aware of specialty coffee and seeking it out – that will only continue to get better for all of us,” he says.

The pandemic may have taken a bite out of the Big Apple, but New York has always proved resilient in the face of adversity, with its historically tough market and notoriously discerning customer base driving excellence and innovation among the city’s coffee businesses.

One thing’s for sure, New York’s legion of coffee shops, cafés and diners are ready to keep the city that never sleeps wide awake – and that looks unlikely to change in the future.

This article was first published in Issue 12 of 5THWAVE magazine.

Subscribe to 5THWAVE to receive each edition in print and digitally or sign up to our newsletter and be the first to read the latest articles and updates on World Coffee Portal research.