Project Café USA 2024, World Coffee Portal’s definitive report on the US branded coffee shop market, reveals the $49.5bn segment now comprises 40,062 outlets and reached 104% of its pre-Covid market value over the last 12 months. However, amid surging industry optimism nearly one fifth of operators have yet to fully recover from pandemic trading pressures

.png.aspx?lang=en-GB&width=700&height=496)

Download our infographic on the US branded coffee shop market | Photo credit: © World Coffee Portal

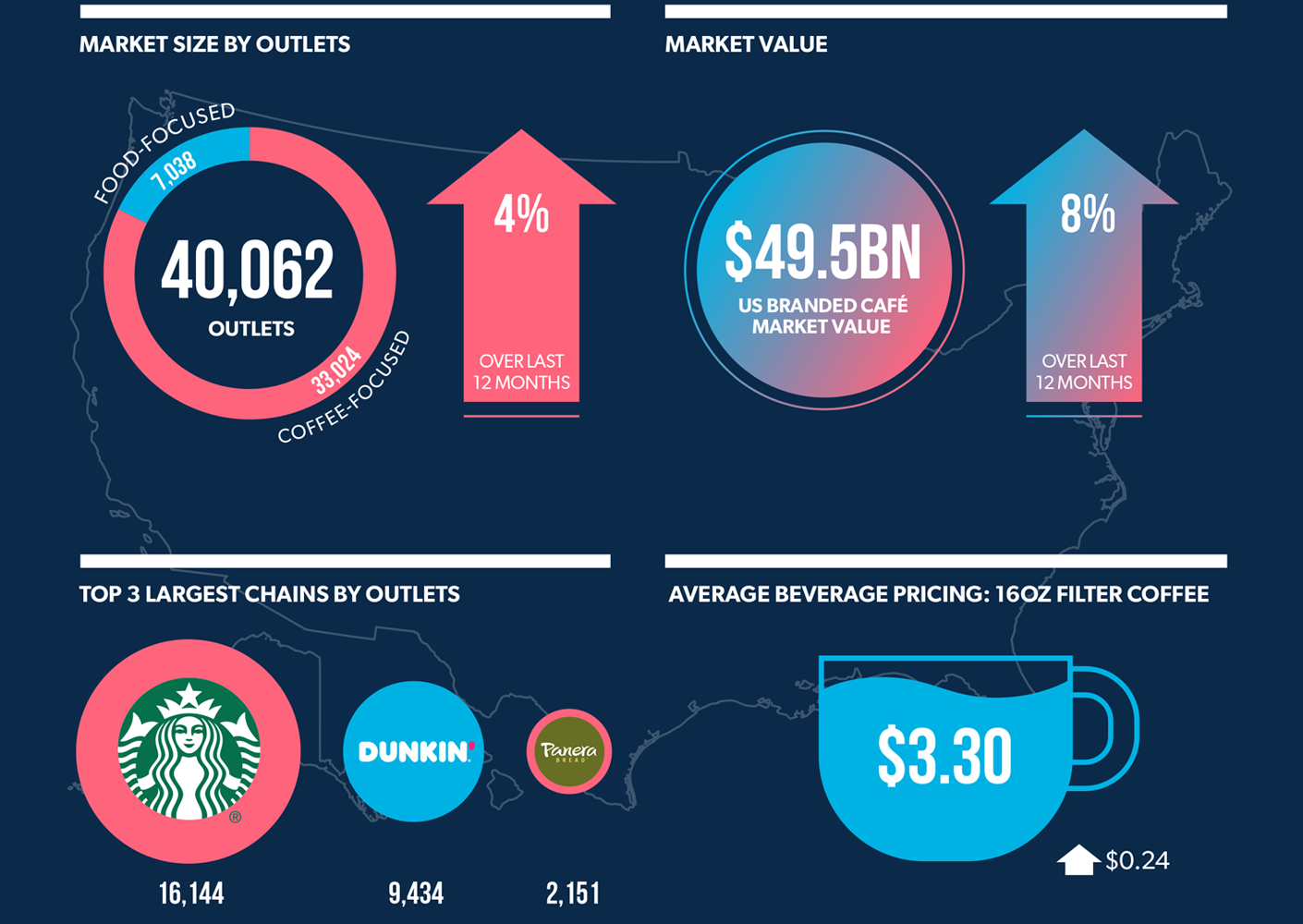

- $49.5bn US branded coffee shop market reaches 104% of pre-pandemic value, achieving 8% sales growth over the last 12 months

-

US branded coffee shop market achieves strong net outlet growth, increasing 4% to reach 40,062 stores

-

World Coffee Portal forecasts total US branded coffee shop market sales will exceed $52.4bn over the next 12 months and $61.6bn by 2028, led by coffee-focused segment turnover

US branded coffee shop market exceeds 40,000 stores and surpasses pre-pandemic value

The total branded US coffee shop market now stands 7% above its pre-pandemic size following robust 4% outlet growth over the last 12 months to reach 40,062 stores.

Market leader Starbucks added 494 net new stores over the last 12 months to reach 16,144. The Seattle-based coffee chain retains a 40% total market share, ahead of Dunkin’ which opened 172 net new stores to reach 9,434 and Panera Bread which closed 22 net sites and now operates 2,151.

The US branded coffee shop market also reached 104% of its pre-pandemic value over the last 12 months, growing 8% to $49.5bn – however, 19% of operators report they have yet to fully recover from pandemic trading pressures.

Industry leaders increasingly optimistic as trading momentum continues

The strong recovery of customer footfall over the last 12 months means most US operators are optimistic about trading. Three quarters (76%) of industry leaders surveyed report a positive sales environment in 2023, compared with 49% last year. Additionally, only 11% cited trading conditions as difficult – 10% fewer than in 2022.

Moreover, 70% of operators surveyed reported sales growth over the last 12 months. However, following a sharp post-pandemic sales rebound in 2022, the number reporting sales growth over 5% fell from 46% to 28%.

Twenty-three percent of consumers surveyed indicated they are now visiting or ordering from coffee shops daily, compared to 16% 12 months ago, while the number visiting at least once a week has risen 5% to 69%.

Cold coffee a key product trend as younger consumers boost sales

Younger consumers continue to drive the cold and iced coffee growth, with 79% of under-35s surveyed typically purchasing an iced beverage at least once a week.

World Coffee Portal’s survey of over 5,000 US coffee shop customers found daily consumption of cold coffee increased 8% over the last 12 months, with iced coffee second only to filter coffee in terms of last coffee shop order frequency.

With 24% of consumers surveyed consuming iced coffee daily, up from 17% in 2022, half of industry leaders now consider cold coffee to be the most important market trend currently – ahead of the rise of specialty coffee (32%) and drive-thru growth (29%).

In-store dwell time on the rise but convenience remains crucial

US consumers are spending more time in coffee shops, with the proportion spending less than 10 minutes in a coffee shop during their last visit falling 5% over the last 12 months to 46% and those staying for up to 30 minutes increasing 13%.

However, indicating that convenience and speed of service remain key service elements in the US, just 4% of US consumers surveyed stayed in-store more than 30 minutes – although consumers under the age of 35 are more likely to dwell for 11 minutes or longer compared to older demographics.

Additionally, 36% of consumers surveyed purchased a beverage to take-away on their last visit, compared to 23% who purchased a beverage to consume in-store.

Further highlighting strong demand for convenience, 56% of consumers surveyed stated a preference for drive-thru rather than physically entering the coffee shop – with drive-thru chains Scooter’s Coffee and Dutch Bros among the fastest growing operators over the last 12 months – opening 224 and 167 net new stores respectively.

Strong trading expected to continue as operators double down on outlet growth

Sales momentum is forecast to continue over the next 12 months with 58% of industry leaders surveyed expecting improved trading conditions next year – just 5% anticipate a deterioration.

Additionally, the number of operators believing that like-for-like sales growth will exceed GDP growth over the next 12 months has increased from 40% in 2022 to 51% this year.

World Coffee Portal forecasts US branded coffee shop sales will exceed $52.4bn over the next 12 months and reach $61.6bn by 2028, displaying five-year growth of 4.5% CAGR.

The total market is expected to exceed 41,300 outlets in 2024 and 45,200 by September 2028, with coffee-focused operators leading growth.

Commenting on the report findings, Allegra Group Founder and CEO Jeffrey Young said:

“To see the number of overall number of stores rising above 40,000 for the first time ever is credible evidence of a very robust market and there are strong times ahead for well-organized operators with strong a focus on customer service and clear brand purpose. Nevertheless, the post-pandemic market still presents significant hurdles for many US coffee chains. A tough labor market, high inflation and squeezed consumer spending will remain major market challenges over the next 12-18 months.”

Project Café USA 2024 is World Coffee Portal’s definitive annual study of the US branded coffee shop market across all 50 states. Our research includes market sizing, sector-by-sector insight, beverage pricing, brand profiles and an in-depth survey of more than 5,000 US coffee consumers.

To purchase the report or to make an enquiry, contact:

Ruth Thompson, Commercial Executive

rthompson@allegra.co.uk

+44(0)20 7691 8800