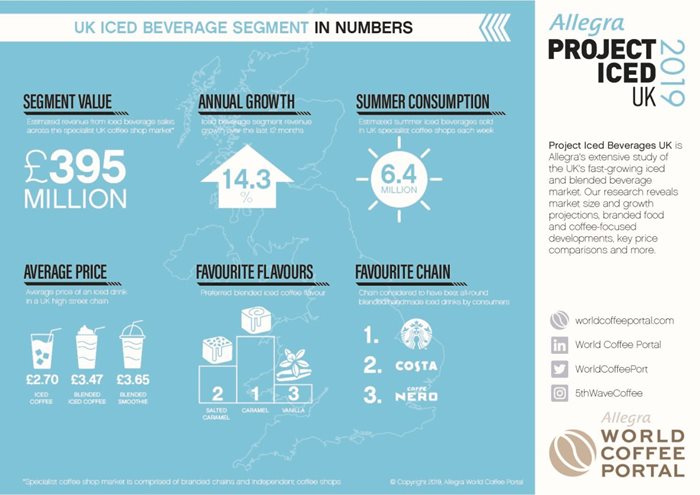

Project Iced UK 2019, World Coffee Portal’s annual analysis of the UK’s rapidly developing iced beverages segment, reveals iced beverage sales grew 14.3% in 2018 to £395m, representing 5.8% of the UK specialist coffee shop segment’s £6.8bn sales revenue*

An estimated 170 million iced beverages are served in UK cafés every year, but trade is still overwhelmingly dominated by summer sales

The UK’s iced beverage segment is expected to build on strong market momentum with sales of £449m forecast for 2019. Allegra estimates over 170 million iced beverages are served in UK cafés every year, but trade is still overwhelmingly dominated by summer sales.

Under-30s hold the key to an iced beverage boom

Forty-five percent of under-30s who drink iced beverages indicate they make a purchase on average every week. This younger demographic is also more likely to purchase iced beverages outside the core June-August sales window, with winter consumption 6% higher than the average across other age ranges.

This indicates operators should catalyse strong interest of on-trend and Instagrammable products, such as cold brew, blended smoothies and freak shakes, toward younger consumers to stimulate broader segment growth and year-round consumption of iced beverages in coffee shops.

Cold brew ready to take the UK by storm

Initially limited to innovative specialty cafés, cold brew is now widely available in the UK, with mainstream market potential continuing to grow. Forty-five percent of industry leaders surveyed identified cold brew as the most significant product opportunity in the iced beverage segment, ahead of handmade iced drinks (42%).

Cold brew sales remain a fraction of hot coffee, but growing availability across the UK’s three largest café chains Costa Coffee, Starbucks, and Caffè Nero has significantly contributed to cold brew’s broader market penetration.

Two-thirds of industry leaders surveyed expect cold brew to become a high street staple within three years. Nitro cold brew is, however, perceived to have far less commercial potential, with just 10% of industry leaders forecasting its widespread availability.

Consumers remain frosty on cold weather consumption and value perception

UK iced beverage sales remain heavily dependent on warm, sunny weather, with sales reaching peak performance June-August and declining from September. Seasonal consumption remains entrenched among UK consumers, with 66% of those surveyed exclusively purchasing iced beverages during hot weather and just 10% willing to purchase during the winter months. Value perception also presents a challenge for operators, with just 24% of UK consumers surveyed agreeing iced beverages represent good value-for-money.

Ready-to-drink raises its game

High-profile product launches from Costa Coffee, Lavazza and Union Hand Roasted Coffee in 2019 demonstrate the growing commercial appeal of ready-to-drink (RTD) coffee in the UK. These products join a plethora of brands already available on UK high street, including ranges from Starbucks, Nestlé, Alpro, Sandows, Jimmy’s and Califia Farms.

Often containing fewer calories and less sugar than blended iced beverages, RTD products can appeal to increasingly health-conscious UK consumers. Half of those surveyed by Allegra would purchase iced beverages more often if they were healthier.

Commenting on the report, Allegra Founder and CEO, Jeffrey Young said:

“Iced beverages continue to represent a growing opportunity for the UK coffee market to innovate, access younger consumers and broaden the appeal of coffee venues. While more work is needed to widen seasonal demand, a robust and diverse iced beverage offer is essential for operators wishing to remain firmly on the pulse of UK coffee market development.”

Project Iced is Allegra’s extensive study of the UK’s fast-growing iced and blended beverage market. Our research reveals market size and growth projections, branded food and coffee-focused developments, key price comparisons and more

Project Iced is Allegra’s extensive study of the UK’s fast-growing iced and blended beverage market. Our research reveals market size and growth projections, branded food and coffee-focused developments, key price comparisons and more.

*The UK specialist coffee shop segment comprises coffee-focused branded chains, food-focused branded chains and independent coffee shops