The phenomenal rise of China's Luckin Coffee, which has opened nearly 3,000 stores since late 2017 and positioning itself as a ket challenger to market giant, Starbucks

.jpg.aspx?lang=en-GB&width=700&height=460)

Luckin Coffee was established in October 2017 by Qian Zhiya, former COO of app-based ride hailing app firm UCAR with $200m venture capital funding

“We have done [in two years] what most people do in 15 or 20 years,” Luckin Coffee CFO Reinout Schakel told reporters in May 2019. Since launching in late 2017, Luckin Coffee, also known as

Rui Xing, has blazed a trail through the Chinese coffee shop market, becoming one of the country’s fastest firms to attain £1bn ‘unicorn’ valuation and opening more than 2,900 stores across 28 cities.

In fact, if Luckin succeeds in its goal to reach 4,500 stores by the end of 2019, the domestic upstart will overtake market leader, Starbucks, which is on track to operate 4,400 stores for the period. But just how is Luckin making its dream of Chinese market dominance a reality?

“Luckin’s new retail model strikes an excellent balance of price and services,” said Luckin CEO Qian Zhiya in an early 2019 press statement. So-called ‘new retail’ was coined by the founder of multinational conglomerate Alibaba Group, Jack Ma, and characterises a shift from physical stores toward e-commerce. Luckin has sought to capitalise on this phenomenon by targeting convenience-driven consumers with digitally enhanced coffee shop experiences. It also launched its first self-serve machines in June 2019.

“We are a new retail model trying to disrupt the traditional model”

– Luckin CFO, Reinout Schakel

By offering 100% arabica coffee at competitive prices, Luckin is seeking to catalyse the significant market potential of café culture and premium coffee in China, particularly among a growing young professional workforce.

This is reflected in the chain’s strong urban centre presence, especially in and around office buildings. By the end of 2018, the company claimed customers anywhere in downtown Beijing and Shanghai could walk to a Luckin store within five minutes.

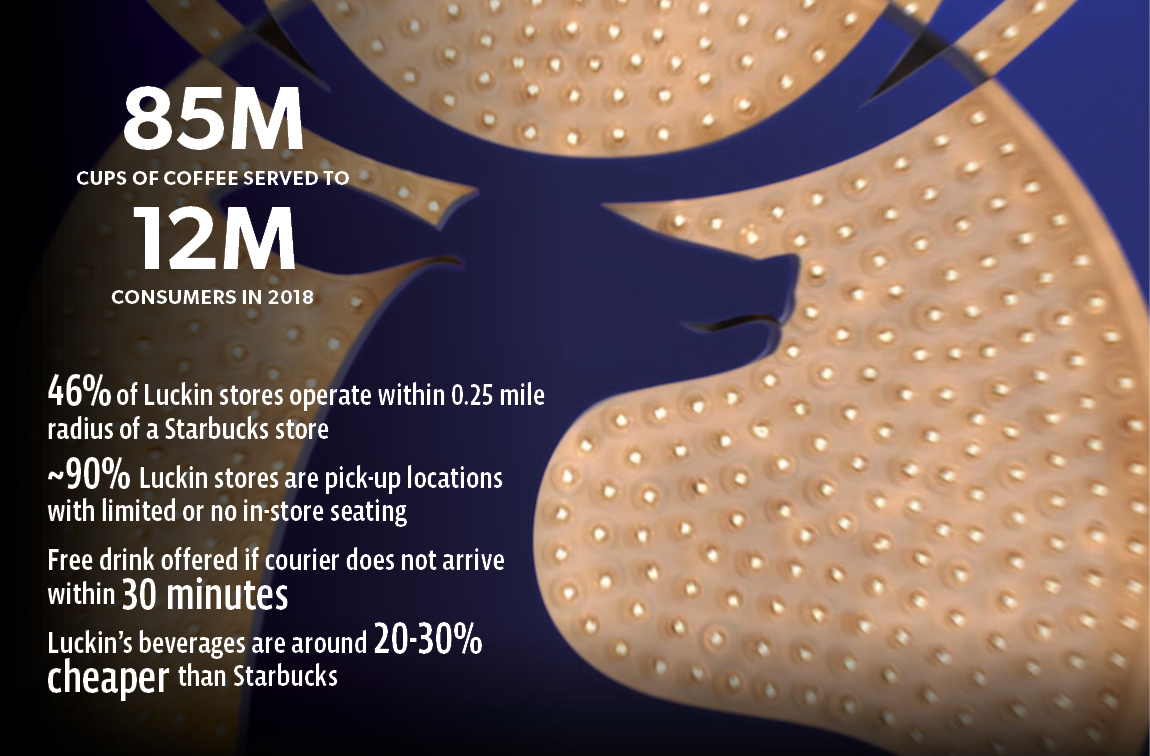

When Luckin began expanding in early 2018, around 30% of its 500+ stores were ‘dark kitchens’ or pick-up points with limited or no seating. By the second quarter of 2018 this proportion had risen to 57%, and by the first quarter of 2019 over 90% of Luckin’s 2,300+ stores were established in this delivery-kitchen format. This approach has enabled Luckin to reduce overheads, such as property rent, staff and utilities.

Luckin Coffee offers a wide range of discount deals via its app, with China's burgeoning young professional workforce a key target demographic

While physical stores are an important part of Luckin’s strategy, technology is central to the firm’s proposition. Orders can be placed for pick-up or delivery via the Luckin app, through which payments can be made via the WeChat and Alipay platforms. Customers can even livestream their coffee being prepared.

This digital focus is unsurprising given Qian’s background as COO for app-based ride-hailing firm UCAR. “The founders of our business are used to using technology and disrupting industries,” acknowledged Schakel in May 2019. “We are a new retail model trying to disrupt the traditional model.”

Luckin has also focused heavily on discounting, with beverages typically around 20-30% cheaper than Starbucks. In 2018, a regular Luckin latte cost 24 yuan ($3.49) plus six yuan for delivery ($0.9), with free delivery on orders over 35 yuan. In comparison, the equivalent grand latte at Starbucks costs around 31 yuan ($4.50).

46% of Luckin stores operate within a 0.25 mile radius of Starbucks

Luckin complements cheaper coffee with a litany of daily discount deals available via its app – with beverages free of charge if they are not delivered within 30 minutes. Given that Luckin claims to have served 85 million cups of coffee to 12 million customers in 2018, these promotions appear effective at entrenching the Luckin brand into consumers’ coffee routines.

“What we are trying to do is bring down the per-cup cost ... with that price point we think we are going to drive mass-market consumption,” Schakel told reporters in May 2019.

Growth at all costs?

Operational efficiency is a key facet of Luckin’s supercharged expansion. In addition to gathering consumer intelligence from its app, the chain also harvests internal data to generate value and openly promotes these resources to woo investors.

‘We leverage big data analytics and AI to analyse our customer behaviour and transaction data, which enables us to continuously enhance our products and services, implement dynamic pricing and improve customer retention,’ reads a Luckin investor brochure.

~90% of Luckin stores are pick up locations with limited or so in-store seating

Yet despite its operational efficiency, Luckin has yet to break even, let alone turn a profit. The firm lost $241.3m during 2018 and made further losses of $85.3m and $99.2 in the first and second quarters of 2019 respectively.

This cash-burning strategy, along with a hotly anticipated yet volatile IPO debut in May 2019, has led to questions over whether Luckin has a viable timeline for profitability. In early 2019 Luckin Chief Marketing Officer Yang Fei said her firm was prioritising scale and speed, stating; “there is no point talking about profit.”

However, appearing to acknowledge market trepidation at Luckin’s sustained losses, in August 2019, Schakel told reporters that [shareholders] “expect us also to get to a sort of EBIT level break-even point somewhere towards the end of next year.”

While some analysts continue to warn Luckin’s strategy of heavy discounting is unsustainable, for now the upstart coffee chain’s supercharged expansion looks set to continue. But the company is building a very different business model to established competitors.

Luckin may well overtake Starbucks in terms of store numbers, but the character of the brand’s scale will be defined by an increasingly ethereal dark kitchen and digital presence rather than the neon glow of brick and mortar stores. With large branded coffee chains the world over investing heavily in app-based transactions, new retail has the potential to redefine coffee shop experiences globally.

First published in issue 2 of 5THWAVE magazine

.png.aspx?lang=en-GB&width=700&height=219)