Warm weather continues to be the key catalyst for iced beverage sales in the UK, but Millennials and Generation Z could hold the key to sustained segment growth. We examine the key challenges, trends and opportunities in the UK’s fast-growing iced beverage market

It could be argued that the UK’s love affair with the coffee shop owes much to coffee culture across the pond. From jugs of filter in the early 90s, to popular sitcoms like Seinfeld and Friends immortalising third place cool and the rise of speciality and single origin – the UK has successfully adopted and built upon some of the best aspects of US coffee culture.

But there’s one area that appears to have been lost in translation. While cold and iced beverages are hugely popular in the States, UK consumers have traditionally had a frostier relationship with the segment. More than half of US consumers surveyed by Allegra said they purchased iced coffee at least once a month in 2016. Compare that to the UK, where in 2018 the figure stands at 19%.

Although the UK may be some way behind the US in terms of year-round iced beverage consumption, the segment is growing rapidly and shows plenty of opportunity for those who can refine their proposition.

Allegra forecasts total iced beverage sales across the specialised coffee shop sector of £421m for 2018, representing a year-on-year increase of 14%. Continued growth is expected over the next five years, with the total sector expected to be valued at £660m by 2022.

With more than half of industry leaders surveyed by Allegra expecting postive iced beverage sales in the next 12 months, how can coffee shops capitalise on this growing trend and what are the major challenges?

Can iced beverages be sold in the cold?

Seasonality plays a big role in UK iced beverage consumption and sales are heavily dependent on warm, sunny weather. Cafés typically have a short window from May to August to extract the most value for their iced range and flexible delivery is crucial.

“You’ve got to be able to react to the weather,” says Danny Davies, Executive Director of London-based roaster, wholesaler and coffee shop, Climpson and Sons. He knows all too well that wet summers, as experienced by large parts of the UK in 2017, can seriously impact cold beverage sales.

Conversely, Davies reveals a surge in cold brew and nitro sales at their east London coffee shops on a recent sunny day that, thankfully, they were prepared for. “As soon as the sun came we sold nearly 80 nitro coffees and 45 litres of cold brew,” he says.

"Our UK customers largely disengage with cold drinks after September – which is very different to an American audience"

However, while Allegra research shows the overall popularity of iced beverages increasing, there’s still no strong indication that the segment will match year-round sales in the US any time soon.

But the weather isn’t an essential factor for cold and iced beverage sales – the UK’s attitude to seasonality is also cultural. Jessica Worden is Coffee Manager at GAIL’s Artisan Bakery. Originally from the US, she says consumers across the pond, even those who live in extremely cold climates, drink iced beverages throughout the year.

“Our UK customers largely disengage with cold drinks after September – which is very different to an American audience, where people are more likely to drink cold beverages year-round – even in areas that have harsh winters.”

Worden goes on to explain that this year-round interest has driven huge innovation in range, preparation and flavour combinations available in the US. But despite its short seasonal sales window, the UK market is also showing progress in expanding and innovating its cold beverages range.

Can cold brew conquer UK coffee shops?

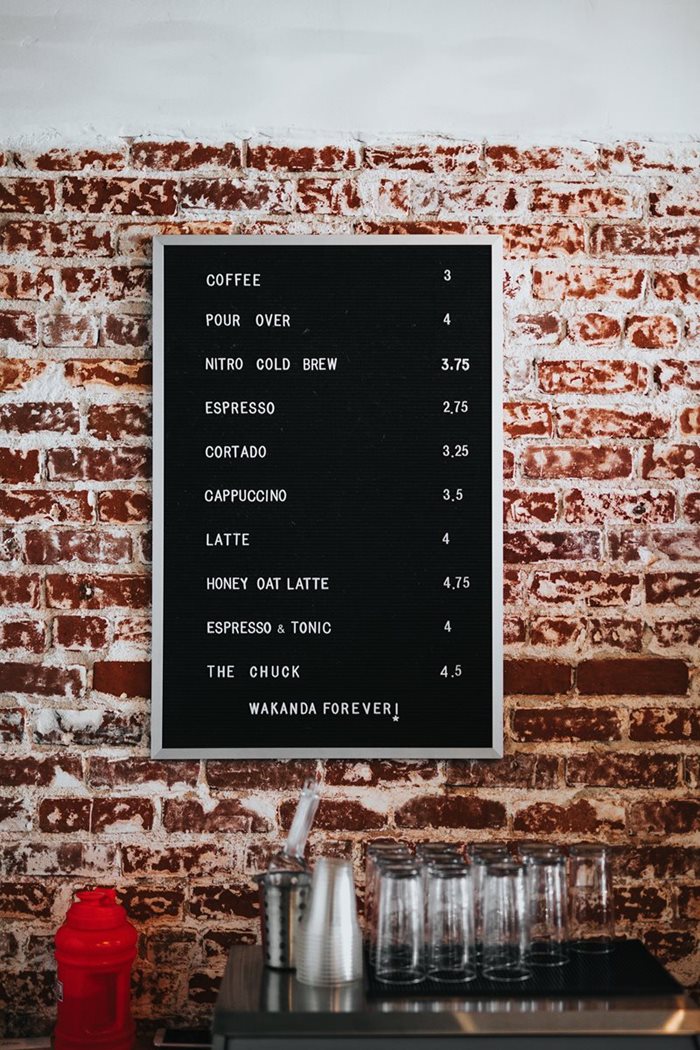

There are now a plethora of ready-to-drink (RTD) and in-store iced products available in the UK, with cold brew showing significant market potential. In fact, well over half of industry leaders surveyed by Allegra believe the beverage will enter the mainstream in the next 3 years.

Lee Hyde is Beverage and Innovation Manager for the UK and Ireland at leading syrups manufacturer, Monin. His company has seen steady growth in their core cold drinks categories, but it’s cold brew that he highlights as one of the biggest trends he’s observing currently, and a category where significant innovation is afoot.

“The great thing with cold brew is you can use flavours like pineapple of blueberry and it works really well. Nitro also benefits from having a little extra sweetness and can really work well with flavours like popcorn,” he explains.

Hyde’s experience chimes with the increasing availability of cold brew products in the UK and their growing appeal among mainstream audiences. No longer the preserve of artisan independents, the UK’s three largest coffee shop chains, Costa Coffee, Starbucks and Caffé Nero all have limited cold brew offers in-store. RTD cold-brew products, such as Nescafe Azera, Fitch Brew Co. and Minor Figures are also gaining popularity on the high street.

"A lot of consumers don’t know what cold brew or nitro coffee is and ask why it’s served in a can"

Founded in 2014, Sandows was the first RTD cold brew brand to launch in the UK and in just four short years the market has evolved significantly. Co-founder and Director, Hugh Duffie, says his company has capitalised on the uptick in cold brew and nitro interest to develop a range of RTD cold brew bottles, fruit-flavoured nitro cans and even carbonated and spiced coffee varieties.

However, although essentially the same core product, the industry view on nitro sales prospects is notably muted when compared to cold brew. A key reason for this is a lack of consumer awareness in the UK, with both suppliers and operators expressing the need for more consumer education on what nitro is and how it differs from iced coffee.

“In the UK there’s still a lot for consumers to understand about the product,” explains Duffie.

“It’s relatively new, so most of the time unless RTD is done by big companies like Starbucks or Kenco, small brands have trouble standing out. A lot of consumers don’t know what cold brew or nitro coffee is and ask why it’s served in a can.”

Duffie also points to marked cultural between UK and US coffee drinking habits. He says greater awareness of cold brew and nitro in the US has driven a critical mass of consumer interest to fuel greater consumption.

“The core proposition of cold brew coffee in the US has much more momentum, which makes new concepts like nitro, sparkling or cold brew with milk all the more successful – there’s just a higher concentration of consumer awareness,” he explains.

"Consumers are looking for new experiences, something they can post on Instagram – that’s what’s really going to grow this year"

A higher-than-average price point and limited availability in major supermarkets has also hampered consumer awareness of nitro in the UK. With many priced above £3, they’re also premium products when compared to cheaper soft drink and juice staples.

Compare that to the £4.39 average coffee shop spend, nitro products represent a big single purchase for consumers wishing to consume multiple items during a coffee shop visit.

However, with the UK’s impending sugar tax slapping the equivalent of a 24p per litre premium on drinks with more than 8g of sugar per 100ml, cold brew and nitro coffee could prove popular healthy alternatives to caffeine-fortified drinks, such as Red Bull and Carabao and even sugar-laden blended iced coffee drinks such as the Frappuccino.

In fact, the inherent sweetness of cold brew means most products don’t even come close to breaching the sugar tax threshold, with many

boasting natural zero-calorie credentials.

Coffee, cocktails and Instagram

But nitro and cold brew coffee aren’t the only iced beverage innovations taking place in coffee shops. UK consumers, especially Millennials and Generation Z, are becoming more adventurous with their iced options, with blended iced coffees, fruit juices and milkshakes all gaining ground.

Allegra research shows those under 30 are more likely to view iced beverages as good value for money and consume them year-round compared to older consumers. With this group driving future sales growth, operators can capitalise on the appeal of photogenic and experimental iced beverages on their menus.

“Flavours and the concepts have become much more sophisticated. This really reflects that consumers are no longer looking for safe – dare I say, boring – flavours. They’re looking for new experiences, something they can post on Instagram – that’s what’s really going to grow this year,” says Monin’s Hyde.

With Monin’s roots in the cocktail industry, Hyde also sees significant opportunity for cocktails and mocktails in the coffee shop. “I’m interested to see where non-alcoholic cocktail and adult soft drinks start dripping out of the cocktail bar sector and into coffee shops and restaurants. I definitely think there’s potential for that,” he says.

It’s this exciting, Instragrammable appeal that is making alcohol an important part of coffee shop diversification, with coffee-based cocktails, coffee martinis, and even coffee beer appearing in cafes targeting evening spend. This has led to an increase demand for pre-made espresso products for use in busy cocktail bars, with espresso martinis particularly in vogue among speciality coffee shops such as London’s Grind and Caravan.

“It’s pretty phenomenal – one of the most popular drinks in the UK at the moment,” says Sandows’ Duffie.

One thing’s for sure – with significant growth forecast over the next five years, iced beverages represent an important opportunity for UK coffee shops. While seasonality looks set to continue underpinning sales, at least in the near-term, Allegra research indicates this near half-billion-pound segment shows no sign of slowing.

Given the increased availability and awareness of iced products in the UK – especially cold brew and nitro – coffee shops should definitely be turning up the heat on their iced offerings.

Project Iced UK 2018, the definitive report on the out-of-home iced beverage market, is now available from Allegra World Coffee Portal, featuring 2,000 consumer surveys, industry insight, latest trends and future growth projections.