While many Brits can’t imagine life without their beloved cup of char, tea out-of-home is a tricky proposition for today’s cafés and coffee shops – we examine the trends, challenges and opportunities

While coffee shop culture has blossomed in the last 25 years, tea’s status on the high street has remained noticeably muted. But that could be changing as a younger, more health-conscious generation adopt a broader, more premium range of single-origin and speciality blends over traditional black tea with milk. Allegra forecasts growth in coffee shop tea sales of 9.2% CAGR over the next five years, with sales valued at £439m by 2022.

Delivering tea consistently out-of-home

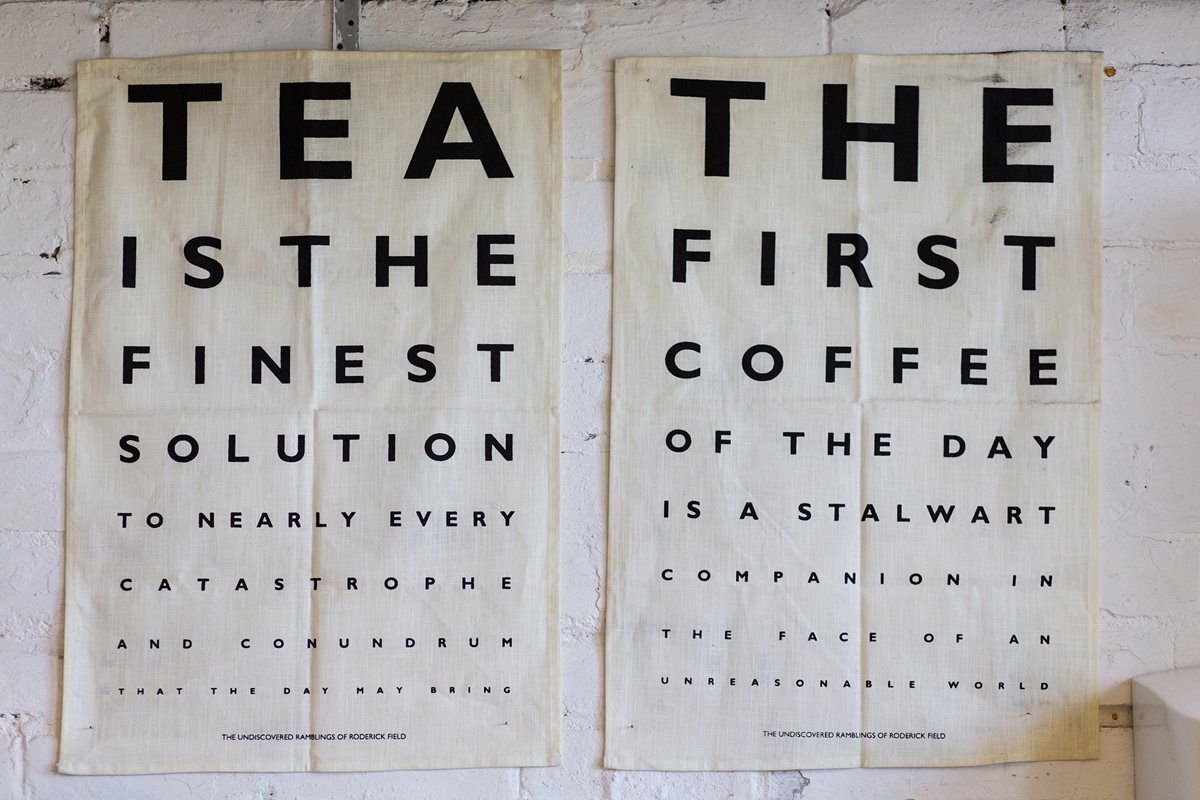

Anyone who’s ever made a round of tea for colleagues knows getting that colour and milk content right can prove a minefield – one person’s brilliant brew is another’s cup of catastrophe. The highly individual ways we take tea is one reason why at-home consumption is still by far the UK’s preference.

For cafés serving hundreds of customers daily, delivering a consistent tea-out-home offer isn’t an easy task. Customers can’t always tell how long their tea has been brewing, especially when served in opaque containers, which can lead to stewing. Transparent tea pots or infusers can be part of the solution in-store but getting adequate brew time for rushed take-away orders can prove equally difficult.

“Tea is a challenge, particularly as we sell a quality product that needs to be brewed for 3 minutes,” says Nick Kilby, co-founder of speciality plastic-free tea bag brand, teapigs.

“People like to take control of how they make their own tea. We’ve placed a lot of emphasis on training our trade customers on how to make it properly. You can you have a good quality, but simple things like water temperature and brewing time make a huge difference to how the product is presented to the consumer at the end of the day.”

Reversing tea’s negative value perception

Another challenge for the out-of-home market is convincing consumers that tea represents value for money. It's no easy task considering the beverage can readily be made at home for fraction of the price-point at cafés and coffee shops. Research by Allegra shows almost a third of consumers believe tea out-of-home represents poor value for money. So how can this perception be challenged?

Jessica Worden is Coffee Manager at GAIL’s Artisan Bakery and oversees the high street chain’s hot beverage selection, quality control and training. She says that the speciality narrative is vital in convincing consumers of the value of tea out-of-home – and educating palettes to drive curiosity for new products.

“I think you’ll find a different relationship to herbal teas over the next 5 years. I’d like to see the engagement with tea quality expand from a recognition of whole leaf teas as a marker of quality,” she says.

“Consumers are drinking slightly less black tea and integrating speciality, herbal or green into their choice"

– Simon Kershaw, Typhoo

“I believe our audiences will come to readily recognise premium tea in the same way that many now recognise the quality characteristics of specialty coffee. People will begin pick teas for flavours they want to enjoy or explore rather than avoid flaws associated with poor quality.”

One of the biggest packers and suppliers of tea in the UK, Typhoo, has also observed a surge in speciality tea consumption. “Speciality teas – your earl greys, chai and black tea variants are growing in nearly double digit in volume growth year-on-year,” says Typhoo’s Category & Marketing Manager, Simon Kershaw.

Kershaw agrees that compelling consumers to pay more out-of-home for a beverage consumed for a fraction of the price at home means increasing choice and pushing a speciality narrative. “It’s important to have a story about tea – what it can do, where it’s from,” he says.

Despite hurdles to overcome, tea rooms and coffee shops appear to be making some headway in winning younger consumers over – under 30s surveyed by Allegra are more than twice as likely than older consumers to drink more tea out of home in the next 12 months.

While there are very real challenges with consumer education and delivery, the popularity of speciality is certainly causing a stir in the tea market. Typhoo has seen a surge in demand for speciality and so-called ‘functional’ teas. As consumers become more adventurous and educated about speciality blends, black tea sales have declined by around 5%, but overall tea sales have been boosted by growth in speciality.

“Black tea is in volume decline purely because consumers are broadening their repertoire of teas,” says Typhoo’s Kershaw. “Consumers are drinking slightly less and integrating speciality, herbal or green into their choice.”

These smaller segments are often several times more expensive, with black tea priced in the region of £6-7 per kg, and fruit and herbals commanding £25-35 per kg. Kershaw goes on to explain that while 80% of tea consumed out of home is black, this represents just 60% of the total out-of-home tea sales. For speciality tea retailers, this can certainly be a case of ‘less is more.’

But with mainstream black tea still making the bulk of sales, Kershaw is keen to stress that offering quality black tea that tastes good and, crucially, offers value for money is still vitally important for tea vendors.

"There is a really interesting trend where some of our tea is starting to outsell some of our core coffee range"

– Jessica Worden, GAIL's

Typhoo isn’t alone in experiencing a tilt towards speciality tea from other beverages. Big product trends such as matcha have recently hit the mainstream, including Starbucks’ much-publicised matcha lattes and Teavana brands. Kumbucha and other health-focussed herbal blends are also gaining traction amid the UK’s health and wellness trend and proving a boon for tea sales.

“Matcha green tea has been a big growth trend – that’s what’s really driving value into the market,” says Typhoo’s Kershaw.

If speciality coffee’s narrative revolves around origin and terroir, then speciality tea is heavily focused on health and wellness. GAIL’s Jessica Worden agrees that health-consciousness is playing an increasingly important role, not just in tea adoption, but in moving away from coffee shop stalwarts, such as the latte and flat white.

“There is a really interesting trend where some of our tea is starting to outsell some of our core coffee range,” she explains.

“Speciality tea keys into an overarching trend of consumers moving away from long milky beverages. As people start moving away from these drinks for health reasons, they seem to prefer drink options with less milk. We see latte drinkers opting for an English breakfast or Earl Grey with milk – drinks experienced as warming and comforting.”

For this reason, Jessica says that speciality tea will play a big role in the high street chain’s future. “There’s a huge opportunity for businesses to grow consumer awareness of premium teas. While health properties attributed to Green teas are important, equally is so the accessible luxury of speciality tea,” she says.

The rise of functional tea

Another key trend observed across the industry is the rise of ‘functional’ tea. While the health benefits of matcha, kombucha and herbal infusions are well-publicised, functional teas are marketed to satisfy specific need states, such as relaxation, digestion, and alertness.

“The biggest development has been a shift away from the mainstream products we’ve traditionally been accustomed to"

– Rakesh Maniar, Vitalize Teas

But will functional teas be crucial to market growth? One firm that has built its brand around the concept certainly thinks so. Rakesh Maniar is MD and co-founder of new functional tea company Vitalize Teas, which offers a range of herbal infusions and speciality teas using natural ingredients that are good for the immune system, energy levels and even improving skin. He says the market is ripe for this burgeoning category.

“The biggest development I’ve seen has been a shift away from the mainstream products we’ve traditionally been accustomed to,” he explains.

“We started Vitalize Teas because we wanted to educate consumers, allowing them to make an informed decision on the products they purchase. We’ve seen consumer preference transfer from conventional black and English breakfast to herbal blends and green teas. Herbal is a growing niche in the functional beverage category and there are a plethora of functional tea products that have come on to the market for detox, slimming, relaxing etc.”

And they’re not just confined the speciality cafés in urban centres – in the last few years there has been an explosion in big-brand functional teas. Fellow UK functional brand T-Plus boasts 50% RDA of essential vitamins in a cup of its tea while Pukka markets a blend aimed specifically at pregnant women. Even UK tea stalwart Tetley has entered the functional tea market with its ‘Super Tea’ range, offering highly specific benefits to the immune system, alertness and heart health.

Tea may not have attracted the same buzz as the coffee industry in recent years, but it’s still heavily ingrained in UK culture. If cafés and coffee shops can harness that potential, tea can become a powerful out-of-home proposition year-round.

“UK consumers have the cultural practice of afternoon tea. A lot of people who’ll have coffee in the morning enjoy tea in the afternoon. Year-round, across the board, tea sales in the afternoon are very good because it is part of known and culturally engrained experience,” says GAIL’s Worden.

And as consumers become more aware of the range of speciality teas available, coffee shops and cafes can add another lucrative ticket to their menus by diversifying their tea offering. With health and wellness at the prominent of the UK’s cultural conversation, speciality teas seem ripe for further growth across the UK market.

“It’s not just the higher-end or more progressive outlets that are upgrading their tea – it’s the more mainstream operators that are doing that now, the bigger contract caterers. It’s becoming more commonplace in offices, casual dining restaurants – the kind of places ten years ago you wouldn’t have seen such good quality tea,” says teapig’s Kilby.

Project Tea Out of Home UK 2018 is Allegra World Coffee Portal's definitive study on the challenging tea out of home market. The report helps industry stakeholders and investors understand the importance of tea to a varied menu in coffee shops and establish a business strategy.